franchise tax board phone number for llc

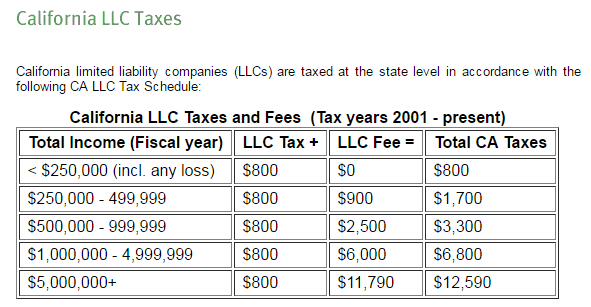

The minimum amount youll have to pay for annual franchise tax is 800 this is required. The excise tax is based on net earnings or.

All LLCs in California must file Form.

. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. If you are a California domestic limited liability company LLC California domestic stock corporation or California domesticregistered foreign. The undersigned certify that as of July 1 2021 the internet website.

Federal Income and Payroll Tax. Franchise Tax Board FTB Our mission is to help taxpayers file tax returns timely accurately and pay the correct amount to fund services important to Californians. While we are available Monday through Friday 8 am-5 pm.

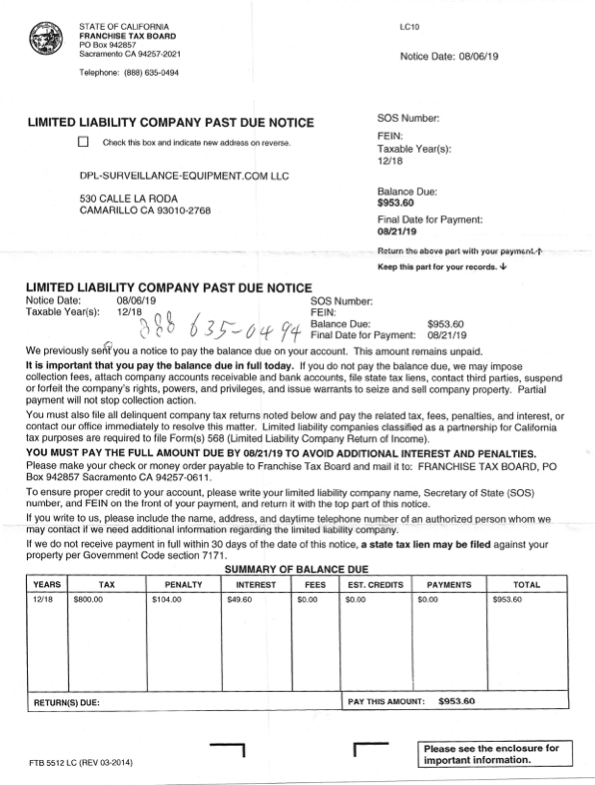

If the LLC has filed Form. Customer service phone numbers. Failure to pay can result in the imposition of additional fees penalties and interest or even revocation of the authorization.

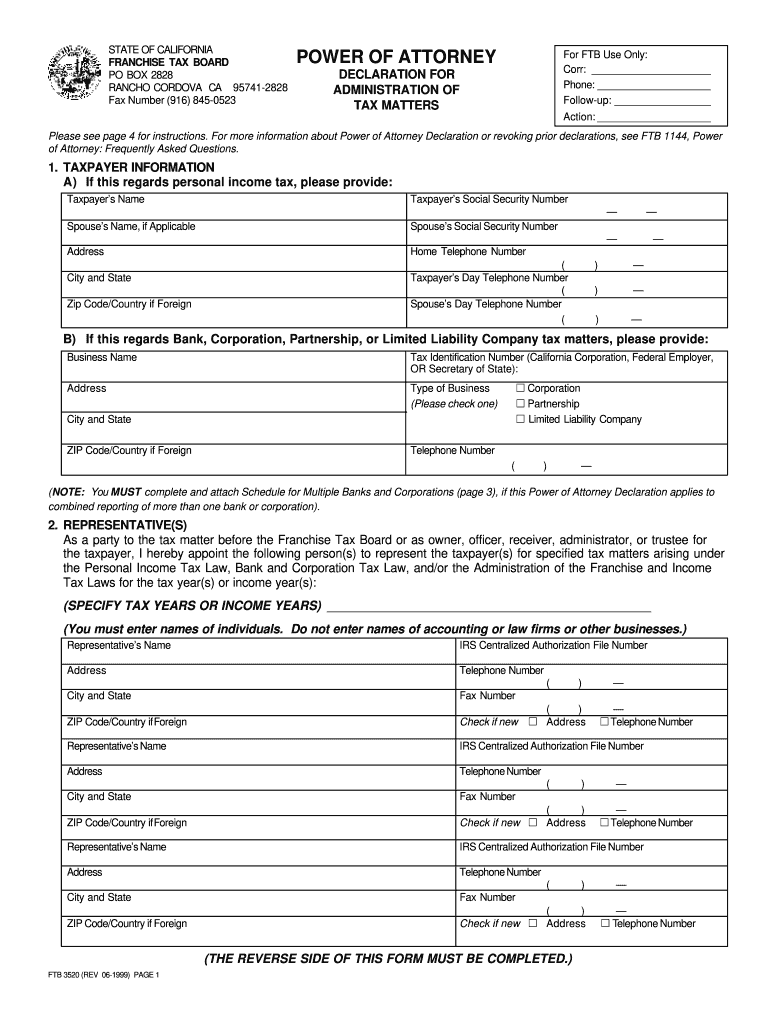

A job well done. Owner Member Power of. Limited liability company LLC forms an LLC to run a business or to hold assets to protect its members against personal liabilities.

Answer 1 of 4. Use FTB 3522 when paying by mail. 916-845-7166 Limited Liability Companies outside the US only 916-845-7165 Partnerships outside the US only Court-ordered debt.

Type of Contact For Limited Liability Companies and Stock Corporations For Nonprofit Corporations. Please have your 11-digit taxpayer number ready. And Address is 300 S Spring Street Suite 5704 Los Angeles CA 90013-1265 USA.

Visit the IRS website or contact a local office in California. Consult with a translator for official business. Federal tax purposes check the Limited liability company box and enter P in the space provided.

Look for Form 3522 and click the download link. Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. Sales and Use Tax.

1 If you simply need to ask someone questions about your business dial this number. Total Sales of Last Return Filed if new entity enter zero Total Amount Paid of Last Return Filed if new entity enter zero Total Revenue from Previous Year if new entity enter zero RT XT. California Franchise Tax Board Contact Phone Number is.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with. Central Time shorter wait times normally occur from 8-10 am. You now owe the annual franchise tax 800 plus an extra 900 in additional fees.

Annual Report - Limited Liability Partnership 2013 and before. And noon Between noon and 5 pm. Find phone and fax numbers to contact us.

3-0925 or 512 463-0925. If the name on line 1 is an LLC treated as a partnership for US. Its about using a Future File Date of 112021 on the California LLC Articles of Organization.

This Google translation feature provided on the Franchise Tax Board FTB website is for general information only. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. In that way because the LLC will go into existence in 2021 it doesnt pay an 800.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Call Back Request Time. Name of Official Document.

Phone or email to appropriate area for extra help. A proposed settlement has been reached in a class action lawsuit against the California Franchise Tax Board FTB challenging the constitutionality of the LLC Fee imposed on limited liability. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

Select Limited Liability Companies. Franchise Tax Board Business Entity Correspondence PO Box 942857. The undersigned certify that as of July 1 2021 the internet website of the Franchise.

Please answer two security questions. Select the appropriate tax year. Form Online Fee.

After that you will also need to pay another 800 in. Here is how to contact an actual operator at CA Franchise Tax Board. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program.

26-54-101 et al also known as the Arkansas Corporate Franchise Tax Act of 1979 requires all Corporations LLCs Banks and Insurance Companies registered in Arkansas to pay an annual franchise tax. If you start to operate an LLC business in California you need to pay the first 800 fee in the 4th month after the approval of your LLC.

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

Franchise Tax Board We Can Help Consulta Gratis 888 468 0609 Servicio Al Cliente 888 959 0207

Even The State Franchise Tax Board Is Trying To Scam Me Dpl

California Llc Annual Llc Franchise Tax Youtube

Franchise Tax Board Ca Ftbfiling Sc Twitter

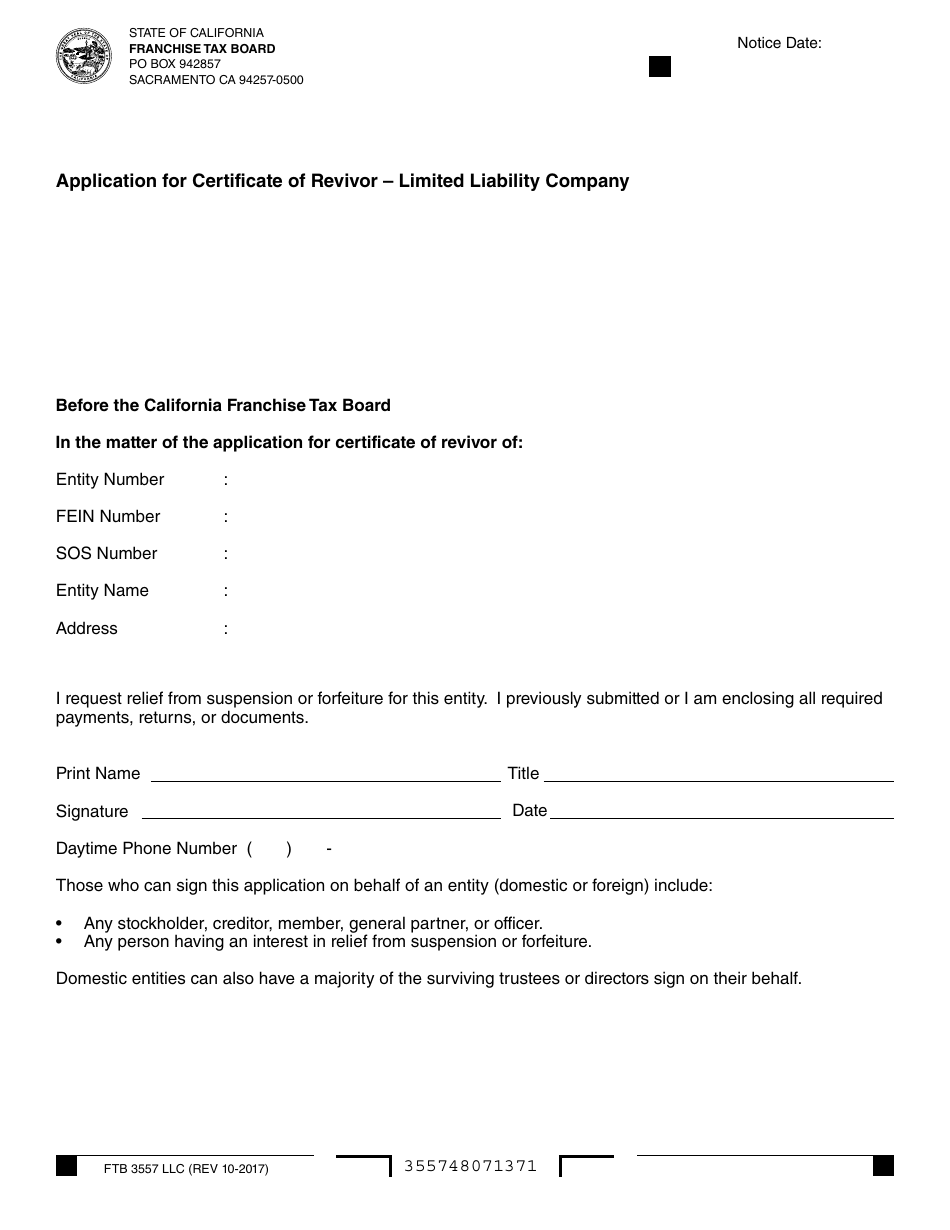

Form Ftb3557 Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Limited Liability Company California Templateroller

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Payments Arrcpa

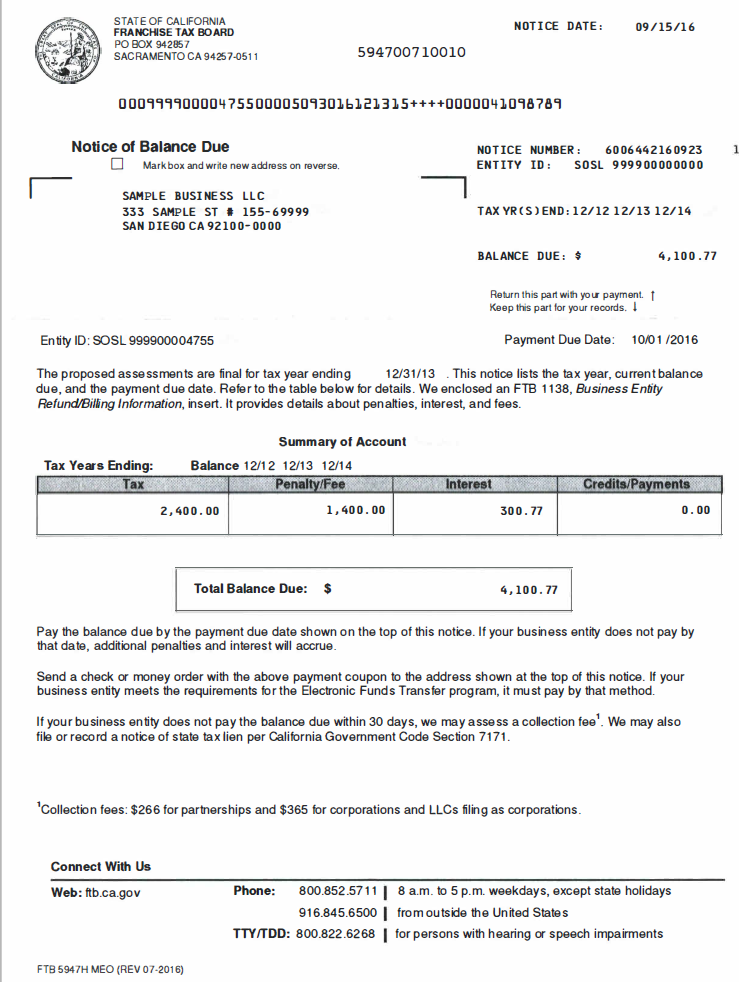

Franchise Tax Board Notice Of Balance Due Llcs Nyc Tax Accounting Services George Dimov Cpa

How To Pay Your California Llc 800 Annual Franchise Tax Online Without Franchise Tax Board Account Youtube

Register A Foreign Llc In California Northwest Registered Agent

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

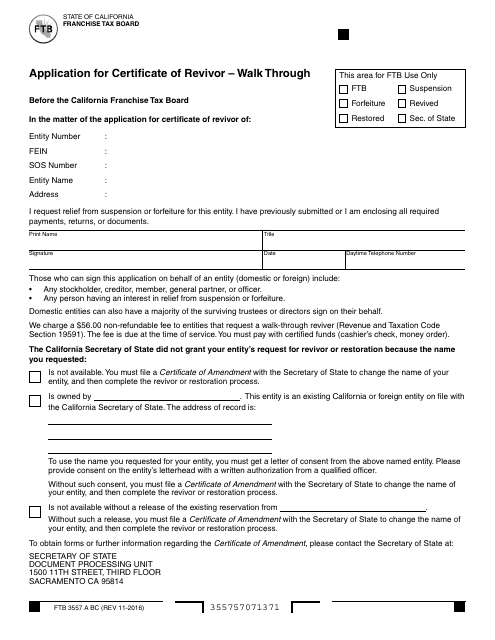

Form Ftb3557 A Bc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Walk Through California Templateroller

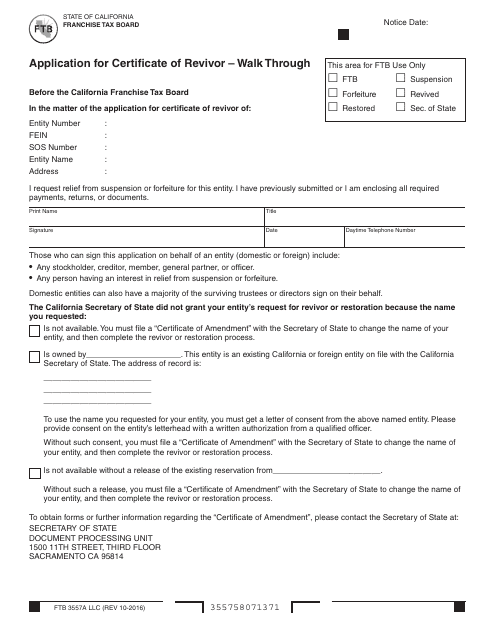

Form Ftb3557a Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Walk Through California Templateroller